What is Antimony?

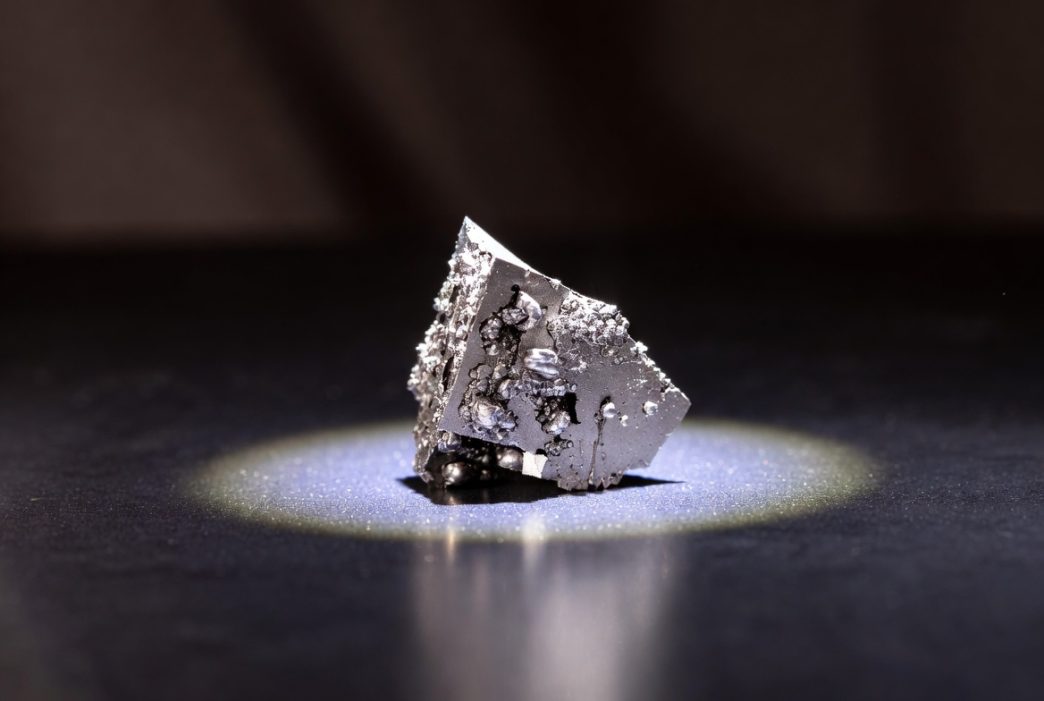

Antimony (chemical symbol Sb, atomic number 51) is the 63rd most abundant element in the Earth’s crust. It is classified as a metalloid—not quite a metal, not quite a non-metal. Antimony exists in two forms: a metallic form, which is bright, silvery, hard, and brittle; and a non-metallic form, which appears as a dull grey powder. Although often grouped with metals, antimony is a poor conductor of electricity and is toxic to humans.

Uniquely, antimony expands when it solidifies, a rare trait that it shares with only a few elements like water.

Global Production and Supply Trends

Global antimony production has significantly declined over the last 15 years. In 2009, total production was around 160,000 metric tonnes (mt), with China alone producing up to 120,000 mt. By 2024, global output had fallen to 100,000 mt, of which China accounted for 60,000 mt, though it still processed roughly 70% of global production into its most usable form: antimony trioxide.

World reserves are estimated at 2 million mt, and recycling, particularly from spent lead-acid batteries, is becoming increasingly important.

Despite this declining output, demand and prices are rising, driven by new industrial applications. In 2021, the market entered a supply deficit, which continues today. In March 2024, antimony’s spot price hit a historic high of $51,500/tonne, though the average price remained around $22,000/tonne—a sharp rise from $12,000 in 2023.